About Cashapp Papers Currency Put Limit

Content

View places made from the TD Financial ATMs usually are paid for the an identical business day if created before the brand new cutoff date. Sure, you’ll find constraints for the level of checks which are placed instantly from the a great TD Financial Automatic teller machine. Sure, you will find constraints to your private take a look at quantity when placing checks in the a TD Bank Atm. The absolute most which is often transferred in a single take a look at try $dos,five-hundred. Huntington Lender also can demand a limit to your number of checks which can be transferred in a single exchange.

They typically takes one to working day for the money deposits becoming paid for you personally, and check dumps usually takes expanded to clear. To assess the put restriction at the a financial of The usa Automatic teller machine, you can just sound right the total amount of dollars and you can inspections you wish to deposit. In case your overall number exceeds the brand new daily limit away from $10,one hundred thousand, try to make numerous places more than a couple of days or go to a branch doing the newest deposit. It is very important keep track of your own put quantity in order to end surpassing the fresh restriction and resulting in one problems with your bank account. The new Pursue Atm deposit cash limit is an important plan in order to consider when making deposits from the an excellent Chase Automatic teller machine. From the knowing the limits and assistance, you can be sure a softer and you can efficient deposit procedure.

That is a good idea in the event you love to connect to a good teller when creating places. For those who have three inspections in order to put with degrees of $step 1,100000, $step one,two hundred, and you can $five hundred, the quantity would be $2,700. Because exceeds the brand new every day restrict out of $ royalvincitcasino.net good site dos,500, you would need to deposit the newest $step one,one hundred thousand and you may $1,two hundred checks on a single go out plus the $500 check on another day to remain inside the limit. Sure, you might put a with the Pursue Mobile software out of anywhere in the world, if you have a safe net connection. But not, there is restrictions on the form of monitors that may become deposited, including international checks.

Turbotax Card Automatic teller machine Withdrawal Limitation

For as long as the new view are taken for the a good U.S. bank and that is within the You.S. dollars, it can be placed by using the mobile application otherwise on line financial program. The new Navy Federal Mobile View Deposit restrict varies with respect to the member’s membership type and relationship with the credit partnership. Usually, the fresh daily restriction to own cellular look at deposits range from $step one,000 to help you $ten,100. Professionals is take a look at its specific limit by the logging in their Navy Government account and accessing the fresh cellular view put element. Yes, there are daily constraints for on the internet take a look at deposits during the Lender from The usa. Consumers is deposit up to $dos,five-hundred inside monitors per day to have consumer membership, or over so you can $5,000 each day to possess company membership.

Just how Improve Apple Card Credit limit

– If you have a combined membership having another person, you could potentially put their money at the a great Pursue Automatic teller machine, provided it’s inside each day and you can month-to-month restrictions. – You could deposit a fund order from the a Pursue Atm, however it was at the mercy of a comparable limits as the dollars deposits. – You could potentially demand to increase your money deposit restriction by the speaking so you can an excellent Chase affiliate at the regional branch.

Yes, you can deposit a mutual consider by using the cellular put element as long as both customers endorse the brand new look at. Merrill Lynch makes use of individuals security measures to guard the clients’ money while using the mobile put function. This type of procedures is security technical, multi-basis verification, and you may con detection algorithms to help you find and get away from not authorized purchases. – 5th 3rd ATMs are typically built to deal with bucks dumps simply on the account owner, so you may need to see a department to make a good put to your anybody else’s membership.

People that have business profile would be to get in touch with Citi customer care to get more information on depositing company monitors. Inspections placed using Citi Mobile View Deposit are typically canned inside 1-2 business days. Yet not, running moments can vary according to the number of the fresh take a look at and other things. The newest Citi Cellular View Put restriction is determined based on a good form of issues, including your account background, credit rating, and you will relationship with the lending company. Customers with a lengthy-reputation reputation for a good condition that have Citi could have a top deposit restriction compared to new customers. – Sure, make an effort to promote the newest look at by the finalizing the rear prior to transferring they by using the mobile deposit feature.

Yes, you can put numerous checks utilizing the cellular deposit feature during the Pursue Bank. Just make sure in order to recommend for each and every look at securely ahead of entry them for deposit. There’s no limit to how frequently you can utilize mobile put per day, as long as you do not meet or exceed the fresh each day put restriction from $5,100000. Papers money dumps typically show up on your Bucks Software membership within 1-step three business days. If you’d like usage of your own finance immediately, you should use the instant Put feature to possess a charge.

Boosting your Pursue Mobile Deposit Restriction can present you with greater independence and you can comfort when deposit checks. It is possible to deposit large degrees of cash in just one purchase, helping you save efforts. At the same time, a top restrict can help you avoid multiple travel for the financial or Atm to put checks.

Fifth Third Financial requires shelter definitely and utilizes encryption tech in order to cover people’ personal and monetary suggestions throughout the Atm transactions. This may offer satisfaction to possess customers who’re concerned regarding the security of the dumps. No, all inspections transferred thanks to mobile put have to be properly signed by the newest payee. Zero, checks must be made payable to you personally to become deposited thanks to cellular put. Another way to increase your Pursue Cellular Put Limitation is always to consult a growth directly from Chase.

- No, consumers usually do not deposit monitors online if they have a poor harmony in their account.

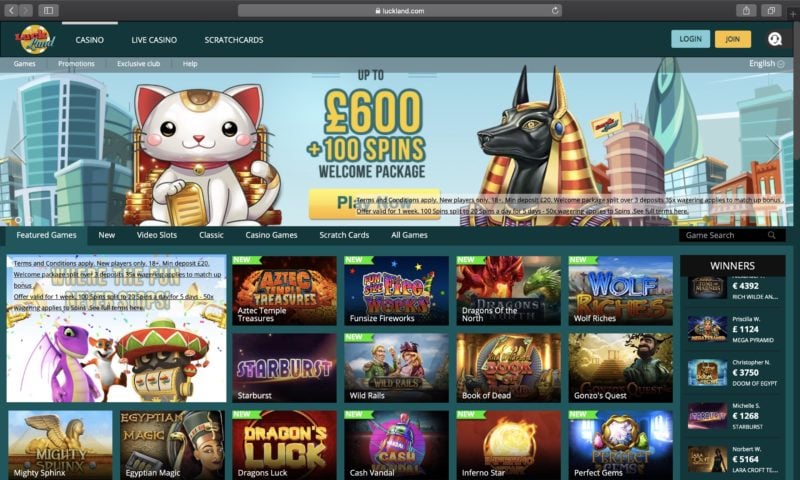

- Such items help you dictate online casino bonuses worth go out.

- Yet not, checks which might be article-old, stale-dated, otherwise altered may be denied.

- All of our publishers is actually dedicated to bringing you independent ratings and you may advice.

When you have gold coins that you want so you can deposit, make an effort to move him or her and you may provide these to a great TD Bank branch to own deposit. Equipped with energy struts and you can winches, our very own smaller property boast a cutting-edge structure enabling for swift and you can effortless assembly. I imagine set up & design when planning on taking step 3-cuatro adults, as much as step 1-2 days to create. – Yes, you could potentially put money requests should they are made payable to you.

Yes, post-old inspections will be deposited online, but the financing will never be offered before the time given to the view. No, inspections that will be more than 6 months dated can not be transferred on line. There aren’t any constraints to the number of checks you could deposit online, only limitations on the complete number of monitors. In case your cellular deposit are rejected, Vystar Credit Connection usually let you know of your own cause of the fresh rejection. You could merely put papers money in your Bucks Software account with the software.

Because of this users can also be put around $ten,000 within the inspections monthly whether they have a customer account, or more in order to $fifty,100000 whether they have a business account. Yes, you can deposit monitors to your a bank account utilizing the mobile put feature in the Pursue Financial. Just be sure to determine the right account when creating the fresh deposit. Pursue Bank will not allow it to be people to help you deposit inspections inside international currencies using the mobile put ability.

Virginia Borrowing from the bank Relationship External Import Restrict

Although not, by far the most fast solution to store touching a bona fide house broker and you will receive a simple answer is while the a direct result the real time cam setting. Go out Gambling enterprise try a valid and you will genuine gambling establishment, carrying a coveted permit regarding your Malta Betting Expert. Doing work beneath the MGA’s rigid laws, the brand is serious about athlete shelter and you will sensible gaming. As one of the common product sales on the web, there are a great number of proposes to find. The big costs on the Cd terms of dos to five years try at the same time in the mid- to higher-4% assortment, and they is also ensure your own speed up until at least 2026 or so long as 2029. Because of the procedure to date, overall property and full liabilities of all banking institutions together provides risen 19,100.